Wallbrook Gold PROJECT

The 192km2 Wallbrook tenement package is considered highly prospective for the discovery of significant gold mineralisation.

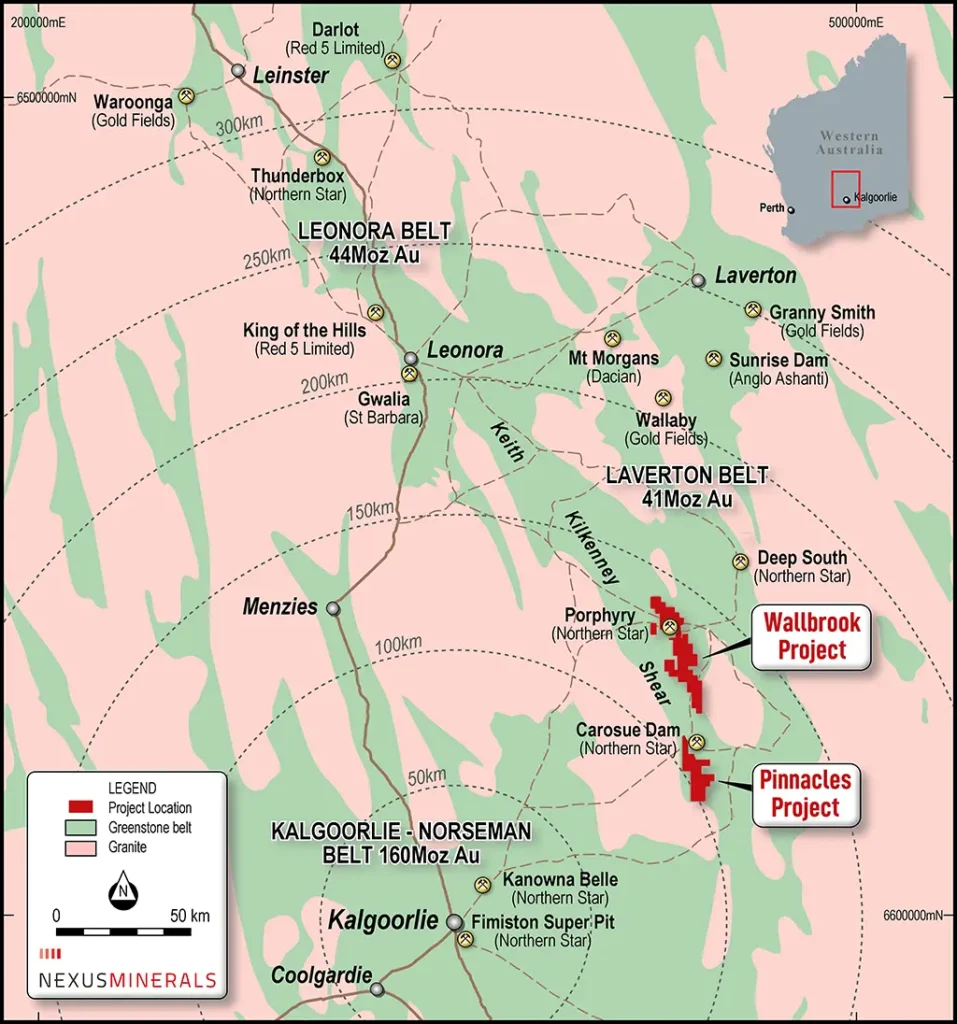

Located 130km north east of Kalgoorlie

The Wallbrook tenement package covers 192km2 and is an amalgamation of tenements acquired from Newmont and Saracen Minerals in 2018.

In November 2018, Nexus completed a Tenement Sale and Purchase Agreement to acquire from Newmont the surrounding 190km2 tenement package adjacent to Nexus’ existing 60km2 Wallbrook Gold Project. Nexus acquired from Newmont the surrounding three tenements covering 190km2 for a total consideration of $13,100 and a 2% net smelter royalty on all mineral product extracted and recovered from the tenements (ASX release 29 November 2018 – Nexus Completes Wallbrook Tenement Acquisition from Newmont).

Nexus had previously acquired the central Wallbrook exploration tenements from Saracen, in January 2018 for consideration of 1,490,000 Nexus shares (ASX release 23 January 2018 – Nexus Wallbrook Gold Project Update).

Regional and Local Geology

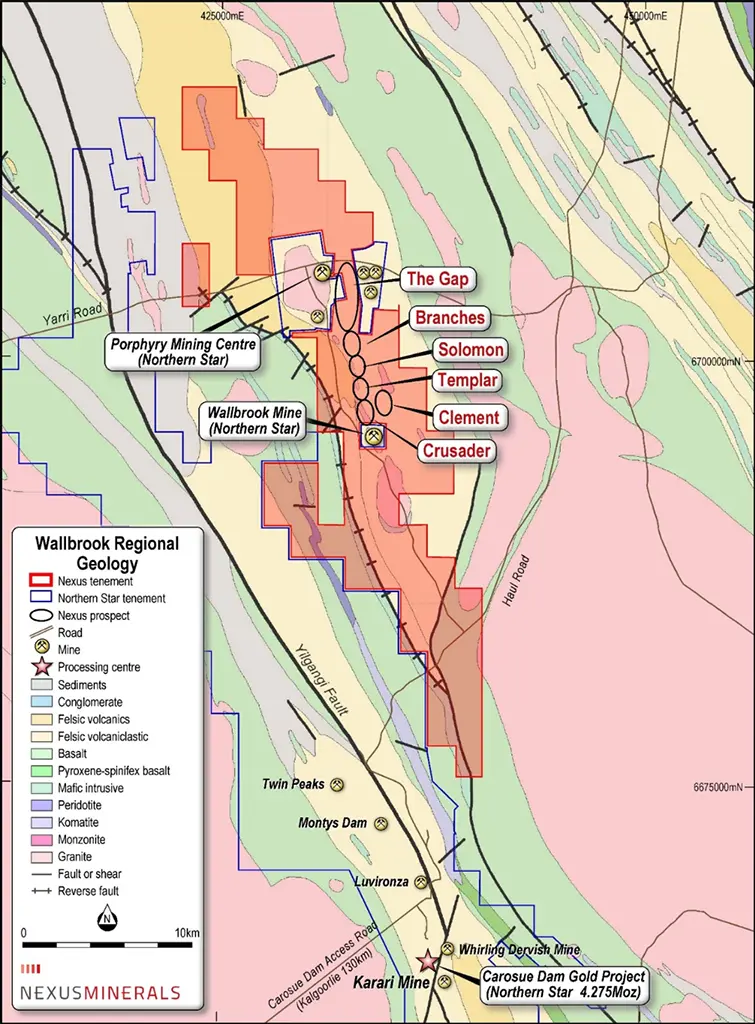

The Wallbrook Project occurs within the Norseman – Wiluna Archaean Greenstone belt in the Eastern Goldfields province of the Yilgarn Craton. The Project is located within the Edjudina Region in the Laverton Tectonic Zone, centrally between Kalgoorlie and Laverton, and 35km north of Northern Star Limited’s Carosue Dam Gold Mining Operation.

The granite-greenstone belt is approximately 600 kilometres in length and is characterised by thick, possibly rift-controlled accumulations of ultramafic, mafic, felsic volcanic, intrusives and sedimentary rocks. Greenstone successions of the southern Eastern Goldfields have been segregated into elongate structural terranes bounded by regional NNW-trending faults (Swager, 1995). These terranes include the Kalgoorlie Terrane, Gindalbie Terrane, Kurnalpi Terrane and the Edjudina Terrane. These terranes contain distinct similarities, including timing of the deposition of volcano-sedimentary sequences (2720-2675 Ma) and regional deformation and plutonism (2675-2620 Ma). The terranes differ only in lithostratigraphic development and early tectonic history (Swager, 1995).

The Wallbrook Project area is located between two major converging tectonic features, the Laverton and Keith-Kilkenny tectonic zones. The Laverton Tectonic Zone (LTZ) forms the central portion of the Laverton Greenstone Belt, running north-south in the eastern parts of the Wallbrook Project. The LTZ is recognized as a world class gold province, with a mineral endowment (production + resources) of over 20 Moz of gold. Major deposits include Sunrise Dam (8.0 Moz), Wallaby (8.0 Moz) and Granny Smith (3.6 Moz). The Keith-Kilkenny Tectonic Zone (KKTZ) has a northwest-southeast orientation and is an important vector to mineralisation in the region between Leonora and Leinster. The southern extension of the KKTZ intersects the Carosue Dam Operation (4.275 Moz).

The lithologies at Wallbrook are dominated by intermediate (andesitic) volcanics, intrusive felsic porphyries and granite. The dominant feature in the project area is the Wallbrook Monzonite. North of the monzonite are relatively smaller granitic intrusions and related narrow felsic porphyry dykes/sills which run predominantly parallel to the regional trend.

The project area covers the convergence of two major trends wrapping around the northern end of the tear-shaped Wallbrook Monzonite. There are several phases of alteration observed, including:

- chlorite + magnetite (associated with regional deformation);

- hematite + silica + sulphides (+ associated felsic intrusives); and

- sericite + silica + carbonate + pyrite + gold (late tectonic + mineralising event).

As with many of the gold deposits within the Eastern Goldfields, gold mineralisation occurred relatively late in the deformational history of the area. Within the felsic lithologies there is a relationship between the hematite/silica alteration and gold mineralisation. Arnold (1999) suggests gold mineralisation is related to hematite bearing oxidized alteration assemblages, with deposition occurring where gold bearing fluids have come into contact with earlier magnetite-hematite assemblages.

Recent Wallbrook Announcements

- Wallbrook Regional Aircore Drilling Commences - July 03, 2024

- Positive Scoping Study for Crusader-Templar Gold Project - June 04, 2024

- Wallbrook Gold Project Drilling & Regional Aircore Underway - May 15, 2024

- RIU Sydney Corporate Presentation - May 06, 2024

- Crusader-Templar Updated MRE Expands to over 300,000oz Gold - May 01, 2024

- Quarterly Activities & Appendix 5B Cash Flow Report - April 16, 2024

- Corporate Presentation - March 14, 2024

- Half Year Accounts - March 13, 2024

- Diamond Drilling Commences - Bethanga Porphyry Cu-Au Project - February 09, 2024

- Exploration Update - November 17, 2023

- 1

- 2

- 3

- …

- 5

- Next Page »

WALLBROOK PROSPECTS

Crusader – Templar Prospect

Nexus announced the results of its Scoping Study on the 4th June 24 (refer to ASX release) – Positive Scoping Study for Wallbrook’s Crusader – Templar Gold Project.

Study Highlights include:

- Various options utilising third-party processing plants operating under a toll treatment agreement were considered. There are currently multiple active processing plants with a radius of 150km from Crusader-Templar. A range of outcomes were defined based on gold price, and processing cost including cost of trucking ore 150km from Crusader-Templar;

- All results outlined are in AUD$;

- The cost parameters used for the Scoping Study would be accurate to +/-35%;

- $3,000 gold price used for study pit shell optimisations;

- Substantial further upside potential exists as this Scoping Study has only assessed the economics based on mining 26% of the current published 5.7Mt @ 1.7g/t for 304,000oz gold mineral resource of Crusader-Templar;

- Using a gold price of $3,500 the Production Target mining inventory for the Project is approximately: 1.5Mt at 1.75g/t producing 80koz gold;

- The Production Target generates an undiscounted accumulated cash surplus of $67M (after payment of all working capital costs and pre-mining capital requirements);

- At a gold price of $4,000 the same Production Target mining inventory generates an undiscounted accumulated cash surplus of $106M, and at a gold price of $3,000 the same Production Target mining inventory generates an undiscounted accumulated cash surplus of $28M;

- Mining is contemplated as a Stage 1 multi-pit campaign over approximately 28 months;

- Average strip ratio across the Stage 1 pits of 16:1;

- Pre-mining capital and start-up costs are estimated to be approximately $2.2M to $3.3M;

- Total funding requirements (including working capital) of between approximately $10M and $15M were estimated based on a Stage 1 “multi-pit” design, providing a 28 month mine life;

- Results suggest that Stage 1 project economics are robust for a broad range of gold prices, with positive outcomes returned above a gold price of $2,635 per ounce.

Areas highlighted for improving initial Scoping Study results are:

- Further RC drilling to “fill out” optimised pit shells and convert material currently identified as waste into mining inventory material;

- Undertake a mining inventory study to supplement the high-grade material (to be transported and delivered to a 3rd party mill) to include the low-grade ore material (0.3-0.7g/t Au) into a heap leach operation study;

- Extend any grade control program to multiple benches beneath the proposed pit floor, where higher grade intercepts have been received from previous RC dill campaigns.

Nexus announced on 1 May 2024 (refer to ASX release) the Crusader-Templar Updated MRE Expands to over 300,000 oz Gold Over 70% Increase in Gold Ounces.

Updated JORC 2012 Crusader-Templar combined Mineral Resource Estimate (MRE) of:

- 5.67Mt at 1.7g/t Au for 304,000 ounces of gold (0.4g/t cut-off)

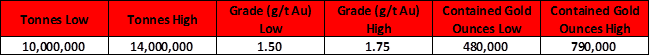

Table 1: Crusader-Templar Mineral Resource Summary (0.4g/t cut-off) (rounding errors may occur)

Table 1: Crusader-Templar Mineral Resource Summary (0.4g/t cut-off) (rounding errors may occur)

Table 2: Crusader-Templar Mineral Resources (0.4g/t cut-off) (rounding errors may occur)

Table 2: Crusader-Templar Mineral Resources (0.4g/t cut-off) (rounding errors may occur)

- The update has resulted in a 70% increase in contained gold ounces

- The MRE was completed by leading industry consultants Snowen Optiro.

- Indicated material comprising 46% of the combined MRE

- The MRE has been reported within an optimised open-pit shell with consideration for reasonable prospects for eventual economic extraction (RPEEE)

- The MRE update has been completed in conjunction with ongoing mine studies

- The project continues to highlight characteristics of a low risk open pit operation, supported by strong metallurgical recoveries, favorable environmental studies, granted mining tenure and access to infrastructure

- In line with mine studies a geotechnical, metallurgical, waste rock characterisation and ground water monitoring, diamond drill program is scheduled to commence in early May

- The MRE remains only a component of the larger Exploration Target previously reported (ASX:NXM 26/3/2023). The deposit remains open to north and south along strike, down plunge of higher-grade shoots, and has potential for parallel lodes to the east

- Systematic regional exploration of the entire Wallbrook project is ongoing with potential to build the projects ounce portfolio over short, medium, and longer term – target pipeline offering Gold Camp opportunity and potential for operational longevity

Exploration Target

Note: The potential quantity and grade of the Exploration Target is conceptual in nature and as such there has been insufficient exploration drilling conducted to estimate a mineral resource. At this stage it is uncertain if further exploration drilling will result in the estimation of a mineral resource. The Exploration Target has been prepared in accordance with the JORC Code (2012).

Nexus undertook major drilling campaigns in 2022 across the 1.6km strike identified to date. Drilling included 68,951m of reverse circulation (RC) drilling and 14,679m of diamond drilling (DD).

The RC drilling was designed to test three main target depths, with a drill rig capacity of 250m vertically. The three zones are:

- Oxide mineralisation – Surface to 100m

- Transition mineralisation – 100 – 175m

- Fresh rock mineralisation – 175 – 250m

The diamond drill program was designed to test for the mineralised sub-vertical porphyry units at depths of >250m, with the intersections used to inform the RC drill program hole locations. These mineralised porphyry units have been mapped from near surface to >600m vertical depth.

Other project work completed included:

- Metallurgical Testwork – on oxide and fresh rock samples with high gold recoveries recorded for both the oxide material (98%) and the fresh rock (97.6%); and

- Flora/Fauna survey – completed with no issues raised.

Examples of RC drilling results (in depth order) include:

Shallow Oxide Mineralisation <100m incl:

- 14m @ 2.44g/t Au and 33m @ 2.09g/t Au (within 84m @ 1.35g/t Au from 9m);

- 11m @ 5.35g/t Au (within 77m @ 1.36g/t Au from 14m);

- 7m @ 2.78g/t Au (within 22m @ 1.02g/t Au from 26m);

- 10m @ 4.48g/t Au (within 16m @ 2.90g/t Au from 31m);

- 7m @ 18.68g/t Au (within 29m @ 5.29g/t Au from 31m);

- 9m @ 7.30g/t Au (within 19m @ 3.81g/t Au from 43m);

- 5m @ 3.55g/t Au (within 16m @ 1.48g/t Au from 70m);

- 12m @ 1.72g/t Au (within 18m @ 1.21g/t Au from 75m); and

- 5m @ 4.96g/t Au (within 12m @ 2.15g/t Au from 91m).

Transition Mineralisation 100-175m:

- 16m @ 2.07g/t Au (within 23m@1.65g/t Au from 102m);

- 20m @ 4.60g/t Au (within 33m @ 2.96g/t Au from 110m);

- 5m @ 4.65g/t Au (within 9m @ 2.88g/t Au from 123m);

- 3m @ 5.78g/t Au (within 15m @ 2.22g/t Au from 143m);

- 2m @ 5.76g/t Au (within 6m @ 1.97g/t Au from 147m);

- 6m @ 5.86g/t Au (within 19m @ 2.41g/t Au from 150m); and

- 3m @ 8.77g/t Au (within 7m @ 4.15g/t Au from 177m).

Deeper Primary Mineralisation >175m

- 4m @ 7.09g/t Au from 188m

- 4m @ 16.14g/t Au (within 9m @ 7.32g/t Au from 203m);

- 3m @ 4.17g/t Au (within 71m @ 0.51g/t Au from 228m);

- 7m @ 4.13g/t Au (within 12m @ 2.90g/t Au from 245m);

- 3m @ 11.40 and 4m @ 9.65g/t Au (within 37m @ 2.10g/t Au from 252m); and

- 8m @ 13.76g/t Au (within 13m @ 8.54g/t Au from 267m).

Regional Exploration

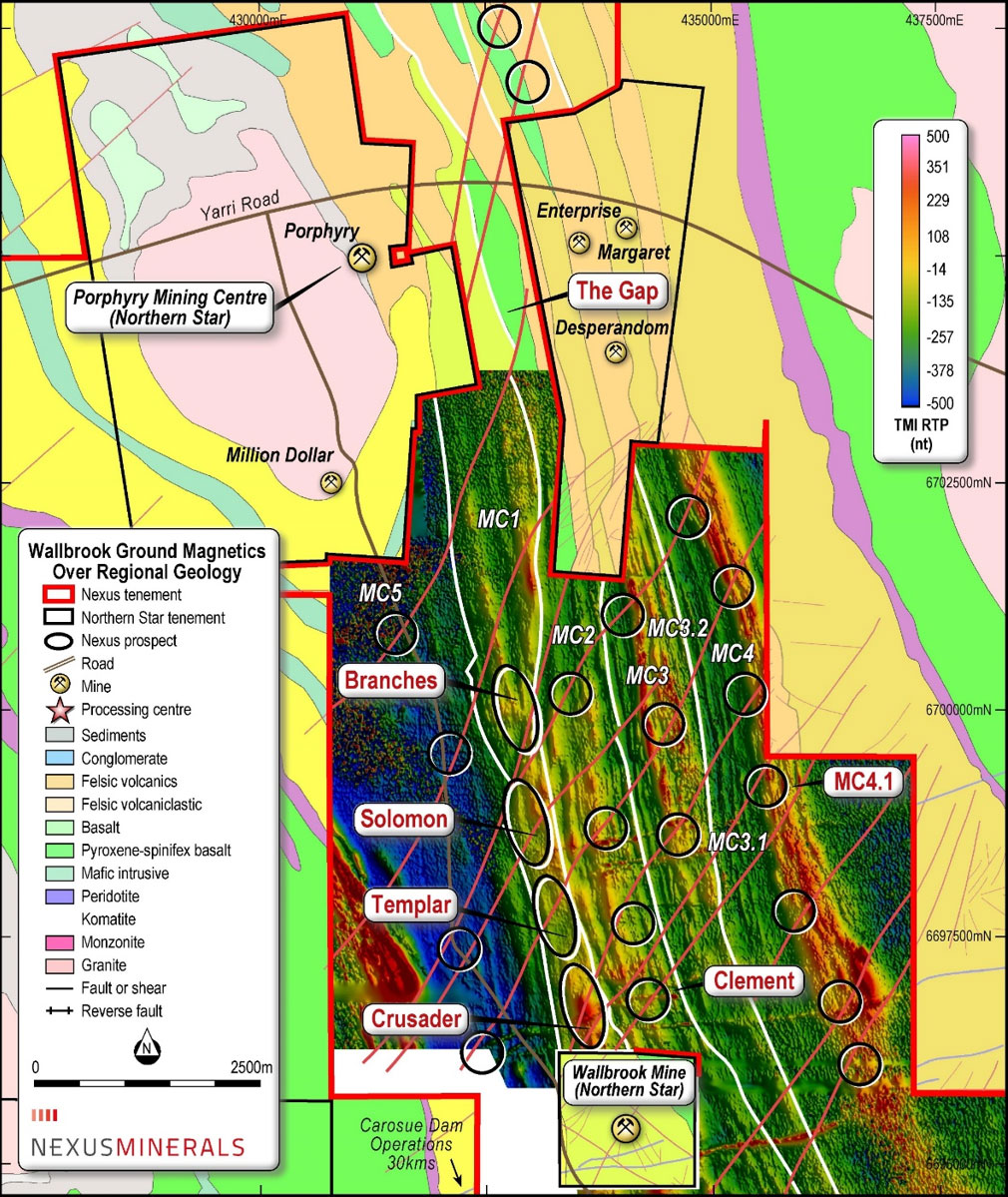

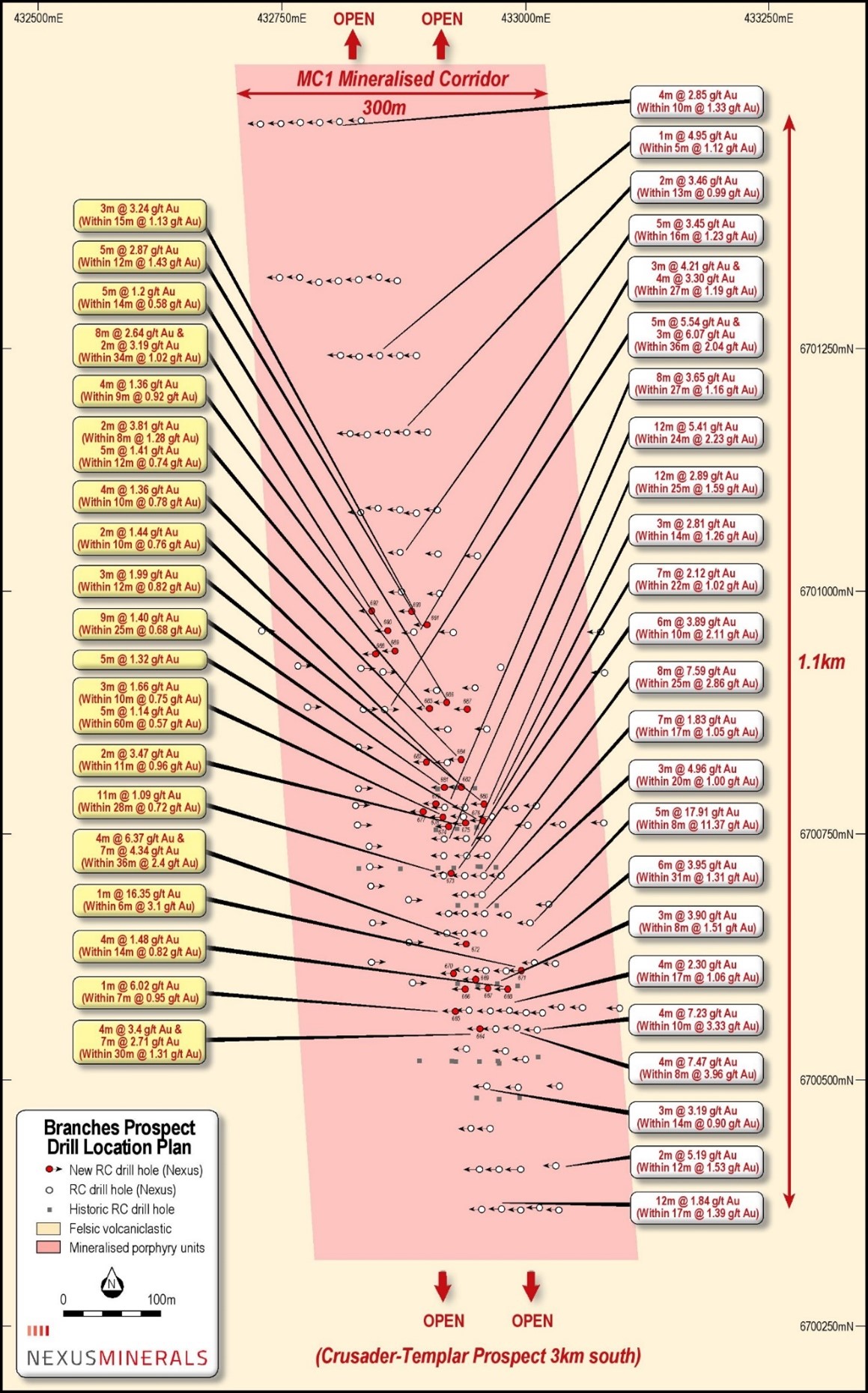

Initial regional drilling has concentrated on the Branches and Solomon Prospects. Solomon lies 800m north of Templar, with Branches a further 2km north. These prospects sit on mineralised corridor 1 (MC1) that has been defined over 5km in length and some 300m wide. The mineralised corridor remains completely open at depth and to the north, where Nexus tenure continues along strike for a further 5km to beyond The Gap Prospect.

In a parallel mineralised corridor, the newly named Clement Prospect is located 500m to the east of the Crusader-Templar prospect on the next mineralised corridor 2 (MC2). An RC drill program was completed at Clement and encouragingly, sheared and hematite altered mineralised quartz porphyry units were intersected. Corridors MC3, MC4 and MC5 remain largely untested.

The results from the Company’s ground magnetics and gravity geophysical surveys continue to be integral in locating the favorable structural settings that host the region mineralisation.

Branches Prospect

The Branches Prospect mineralisation is associated with sheared and hematite altered mineralised quartz porphyry units – “the right rocks”. These are the same rocks that host the gold mineralisation at the Company’s Crusader-Templar Prospect located 3km to the south and Northern Star’s multi-million ounce Carouse Dam Gold Project a further 30km to the south.

Significant Branches drilling results (in depth order) include:

- 4m @ 6.37 g/t Au & 7m @ 4.34 g/t Au (within 36m @ 2.40 g/t Au from 18m)

- 8m @ 2.64 g/t Au & 2m @ 3.19 g/t Au (within 34m @ 1.02 g/t Au from 20m)

- 4m @ 3.40 g/t Au & 7m @ 2.71 g/t Au (within 30m @ 1.31 g/t Au from 25m)

- 12m @ 5.21g/t Au (within 24m @ 2.23g/t Au from 25m);

- 8m @ 3.65 g/t Au (within 27m @ 1.16g/t Au from 26m);

- 3m @ 4.21 g/t Au (within 27m @ 1.19g/t Au from 27m);

- 5m @ 3.45 g/t Au (within 16m @ 1.23g/t Au from 38m);

- 5m @ 5.45 g/t Au and 3m @ 6.07g/t Au (within 36m @ 2.04g/t Au from 43m);

- 8m @ 7.59 g/t Au (within 25m @ 2.86g/t Au from 43m);

- 4m @ 7.47 g/t Au (within 8m @ 3.96g/t Au from 73m);

- 6m @ 3.95 g/t Au (within 31m @ 1.31g/t Au from 113m);

- 4m @ 7.23 g/t Au (within 10m @ 3.33g/t Au from 115m);

- 5m @ 17.91 g/t Au (within 8m @ 11.37g/t Au from 118);

- 1m @ 16.35 g/t Au (within 6m @ 3.10 g/t Au from 120m)

- 3m @ 3.90 g/t Au (within 8m @ 1.51g/t Au from 124m).

SOLOMON Prospect

At the Solomon Prospect, located 800m north of Templar, drilling has intersected similar host rocks and alteration styles to those observed in the Crusader-Templar mineralised corridor. That being a hematite altered / silicified quartz porphyry that has intruded a volcaniclastic host rock unit. Recent results include:

- 10m @ 3.40g/t Au (within 22m @ 1.88g/t Au from 123m);

- 3m @ 4.69g/t Au (within 26m @ 1.06g/t Au from 258m);

- 3m @ 1.79g/t Au (within 6m @ 1.06g/t Au from 34m);

- 2m @ 1.55g/t Au (within 8m @ 0.52g/t Au from 43m).